August 26, 2021

Author: ROB ZILIAK, CFP®

Chief Experience Officer

Imagine that, in the foreseeable future, you’ll have turned in all your company property, collected your final paycheck, and will be drinking a hurricane at half past noon while chair-dancing to “It’s Five O’Clock Somewhere.” You’ve planned on reaching that celebratory beach vacation over the many years of your career while also designing, building and protecting your financial life. By 65 you have diligently accumulated the wealth you need to retire. You’ve won the game, earning satisfaction and congratulations for completing a solid plan. Other than tee times, volunteer activities or family trips, there isn’t much planning left to do, is there?

Of course there is, or there wouldn’t be a need for this article. In reality, you’re just beginning the second phase of your adult financial life. While it is indeed 5 o’clock somewhere, you need to determine whether you’re in the right time zone to start celebrating or whether you’re actually running a couple hours behind. The time to evaluate your situation is now, rather than waiting until after you’ve jettisoned yourself from the workforce.

Essentially, there are two phases in your adult financial life: accumulation and distribution. From your graduation through the collection of your final earned income paycheck, you are in the accumulation phase, during which the goal is to generate financial resources sufficient that you won’t run out of money before you run out of time. You may have more goals than this simple benchmark, yet virtually everyone’s minimum objective is to provide for their own needs in retirement rather than becoming a financial burden to their children.

Once there is no more earned income, the distribution phase begins. Conversion from the accumulation to the distribution phase is a paradigm shift that requires prudent strategies to manage and execute. My nearly three decades in financial services has taught me that, for most people, the distribution phase generates greater emotional angst than the accumulation phase. Even though the purpose of accumulating assets over a career is to distribute them throughout your non-working years, the fear of spending money when you’re not earning income can be overwhelming. What if we spend too much, too fast? What if we live longer than anticipated? What if we need assisted living or skilled nursing care? Can we support our kids’ families if they need help? Can we afford to spoil our grandchildren? What if we need to support one or more of our parents if they run out of money or go into poor health? How much travel can we afford? Do we need to sell our lake home and boat so we can afford other lifestyle priorities? All of these relevant questions, and more, can be answered with proper advanced planning, which will provide the necessary peace of mind to spend joyfully, with confidence.

Short of being diagnosed with a terminal ailment, it’s highly unlikely you will know precisely how many years you have post-career. According to the Social Security Administration’s life expectancy calculator, today a 65-year-old woman should estimate living approximately to 87 and a 65-year-old man until 84. Yet, life expectancies have increased rapidly, as has the cost of the medical care that’s extending our lives. As a result, retirees should financially prepare for maintaining an acceptable standard of living until at least 90. We now have an end goal in mind; specifically, to support lifestyle needs for two people (assuming you’re married or have a partner) over the 25 years following retirement without running out of money. The list of wealth management and preservation issues to plan for over multiple decades is substantial, and dynamic, so many of these elements may need updating several times. All of the following areas, while not an exhaustive list, can affect successful distribution outcomes: retirement income planning, portfolio planning, tax planning, risk management planning and legacy planning.

Retirement income planning is necessary for funding your lifestyle once there isn’t a paycheck. It includes strategies for optimizing Social Security retirement benefits, required minimum distributions (RMDs), withdrawals from taxable accounts and, possibly, pensions, annuities or rental income from real estate. Without addressing and coordinating these many moving parts, how will you know the most effective way to obtain the money you need to pay monthly expenses?

Portfolio planning is necessary to pursue goals-based results through periodic retirement projection updates. If your spending desires require your portfolio to generate 5% returns net of taxes and fees, yet your portfolio is structured to generate 3% returns after taxes and fees while inflation sits at 3%, your adult children may need to have a bedroom available for you down the road. Similarly, using proper asset location to place the right type of tax-efficient and tax-inefficient investments into the right types of accounts can help increase after-tax returns. Your personal return, net of taxes and fees, is what counts toward your future financial success, not the gross investment return itself.

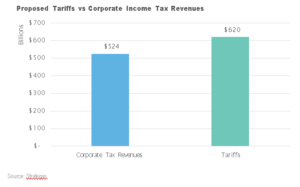

Taxes have the ability to erode retirement income, investment returns and Social Security benefit payments quickly. We’ve experienced a relatively low tax environment by historical norms in recent years, yet, based upon the many pending proposals for new tax laws, chances are high that taxes will become a bigger factor in future financial outcomes. After paying significant taxes over your career, you have many options available to reduce the impact of taxes throughout retirement. At a minimum, proper advance tax planning should take into consideration the present year and your projected lifetime. The key is to look forward and make intentional decisions rather than waiting to be told how much you’ll owe in taxes or simply increasing estimated quarterly tax payments.

Risk management includes all forms of insurance coverage; you may be over-insured, under-insured or appropriately insured in any given area. Health insurance, Medicare and Medicare supplements included, is quite complex and long-term care insurance is even more difficult to navigate. If you and your spouse need healthcare support for multiple years at a cost of, say, $100,000 annually (which is a realistic amount for care), will you still have money to use elsewhere? In other words, can your financial projections remain positive if total out-of-pocket expenses for two adults to receive in-home care, and/or move into assisted living, and/or live in a nursing home facility reach $500,000? According to a new cost-of-care survey, 70% of Americans may need at least one form of long-term care, so the odds are too great to ignore proper management of health risks.

Legacy planning can be as simple as having your accounts updated with your desired primary and contingent beneficiaries. Do you still have a former spouse listed as the primary beneficiary on that long-forgotten IRA? However, planning your legacy also includes keeping your estate documents current to ensure the people and charities you care for the most will be the recipients of your assets. Returning to the topic of taxes, without tax law changes, federal estate and gift tax exemptions will effectively be cut in half at the end of 2025. Pending tax law proposals, if they become law, may reduce the exemption considerably lower than is projected for 2025, and the reduction could come as early as 2022. Therefore, many more heirs and beneficiaries may find themselves subject to federal estate taxes without proper estate planning. Remember to include a living will and powers of attorney as well, so that a loved one or two can make critical medical and financial decisions on your behalf in the event you become incapacitated. Many financial and healthcare institutions will not honor documents that are older than five to seven years, so remaining current is a necessity.

A fair question is when, given current trends facing those considering retirement, you should address all these issues. The answer is to start solving the most critical of them now, if they’re not already solved. None of our time is guaranteed, and the fastest way to alleviate the risk of unintended consequences is to plan accordingly while you are still mentally and physically able to do so. While we need to plan for a lengthy lifetime in retirement, it’s in no way a given, so enjoy whatever time is in store for you. Just consider properly organizing your affairs now, for the benefit of your surviving loved ones.

Given the abundance of distribution-phase planning considerations, it’s understandable if you are now craving a second or third hurricane before packing up and leaving for that retirement beach vacation. After all, you’ve had a wonderful career by excelling at your chosen profession, not because you completed a master’s degree in personal financial planning. Establishing a holistic, evidence-based planning and investment strategy that answers emotion-laden questions will allow you and your spouse or partner to distribute wealth with confidence. If you are unsure how to approach any or all of these topics, connect with a well-credentialed, fiduciary wealth advisor that can quarterback solutions for all these issues. Once you are confident that you are in the right time zone, convert to island time and enjoy the relaxed pace.

This commentary originally appeared August 17 on thestreet.com.

The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Strategic Partners®. This article is for general information only and is not intended to serve as specific financial, accounting or tax advice. Individuals should speak with qualified professionals based upon their individual circumstances. The analysis contained in this article may be based upon third-party information and may become outdated or otherwise superseded without notice. Third-party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed.

By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. IRN-21-2455

© 2021 Buckingham Strategic Partners®

by Launch Kits

by Launch Kits