By Daniel Campbell, CFA

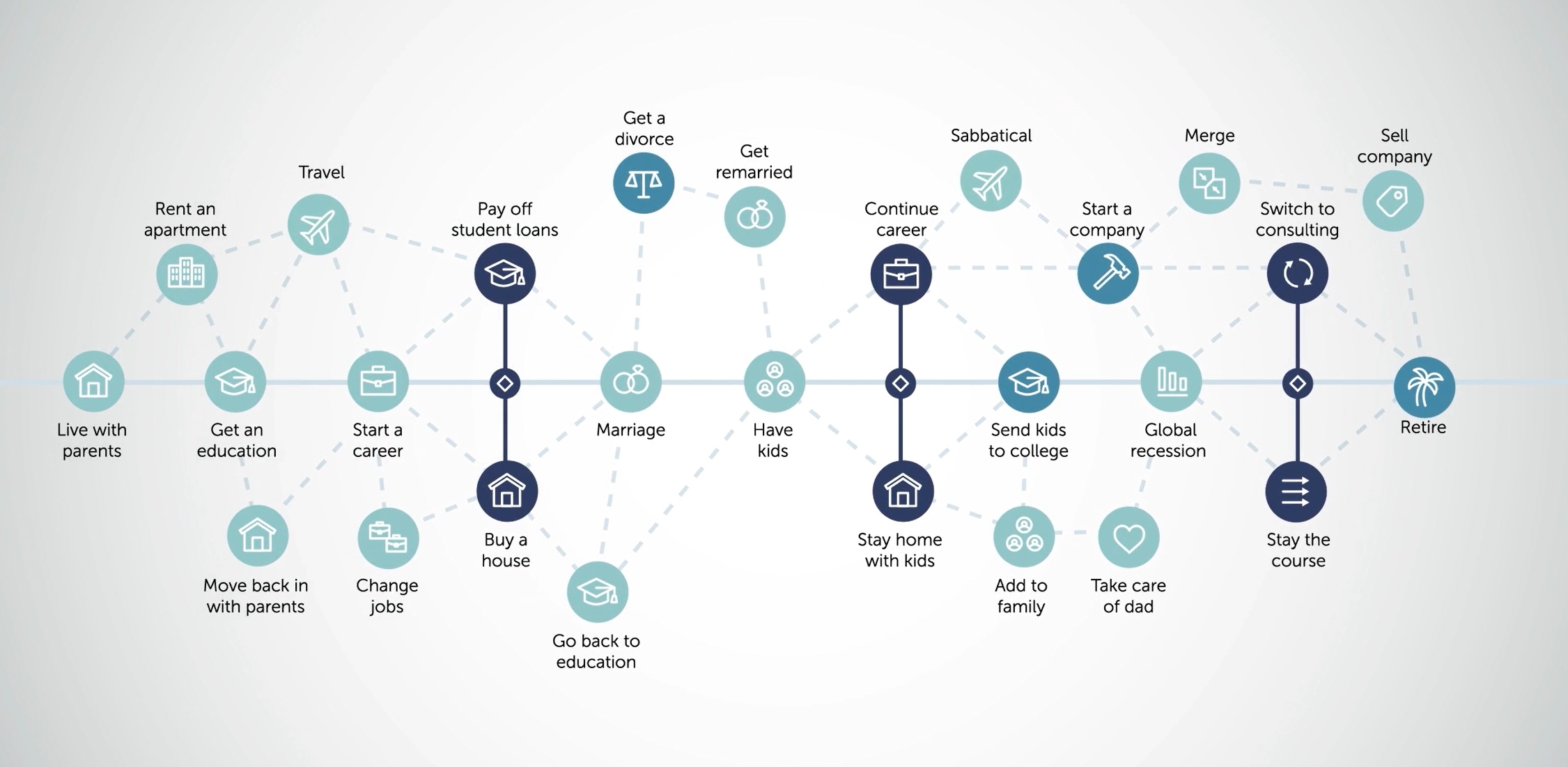

For the first time in over 50 years, both stocks and high-quality bonds were down in 2022. The last time this happened was 1969, and the story is eerily similar to what we just experienced. Following a decade-long expansion spurred by fiscal budget deficits and relatively low inflation, the Federal Reserve became increasingly concerned about rising prices and hiked the fed funds rate over the year to combat inflation. This is a strategy the Fed uses to control inflation: raising the cost of borrowing to curb demand for goods and services.

Source: FRED, Federal Reserve Bank of St. Louis. Ken French Data Library, Dimensional. Stocks are represented by the Fama/French Total US Market Research Index Portfolio, which is an unmanaged index of stocks of all U.S. companies operating on the NYSE, AMEX, or NASDAQ. Bonds are represented by Five-Year U.S. Treasury bonds, from Dimensional. Analysis assumes the portfolio is invested at 60% U.S. Stocks and 40% bonds at the beginning of January 1969 and the portfolio is not rebalanced. Assumes that all dividends are reinvested.

In both 1969 and 2022, as the Fed’s determination to fight inflation at all costs became clear, markets responded hastily. The above comparison also illustrates a pattern: Although bonds tend to offset stock market losses, both investments have declined during periods of rising inflation and aggressive Fed policy. However, consistent with other rising rate environments in history, certain types of companies performed better than others in 2022.

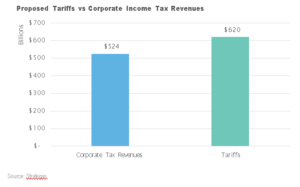

1. Source: Morningstar. Year-to-date through Dec. 8, 2022, Meta was down 66%, Netflix was down 49%, and Peloton was down 65%.

2 Source: Morningstar. In the U.S., the Russell 3000 Value index, a measure of value stock performance, was down 6.7% compared to the Russell 3000 Growth index, which was down 25.7%. Internationally, the MSCI World ex USA Value Index was down 5.9% compared to the MSCI World ex USA Growth index, which was down 20.8%. All return figures through Dec. 8, 2022.

For informational and educational purposes only. The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Wealth Partners®. This article is for general information only and is not intended to serve as specific financial, accounting or tax advice. Mentions of specific securities are for informational purposes only and should not be construed as a recommendation.

© 2023 Buckingham Wealth Partners. Buckingham

Strategic Wealth, LLC & Buckingham Strategic

Partners, LLC (Collectively, Buckingham Wealth Partners) R-22-4767

by Launch Kits

by Launch Kits