By

Matt Nelson, MBA, CFP®

Planning IRA distributions can be a challenge, especially for non-spouse beneficiaries who inherit the account from a deceased loved one. Making this dilemma even trickier to navigate – as of 2020, most non-spouse beneficiaries who inherit an IRA must distribute all funds from the account by the end of the 10th year after the original IRA owner died.

Is it better to take annual distributions or wait until the 10th year to withdraw the funds? Although the IRS is still working to clarify its rules on taking required distributions during the 10-year window, those who inherit an IRA could avoid a big tax bill by planning early.

How could planning IRA distributions help save on taxes in the long run?

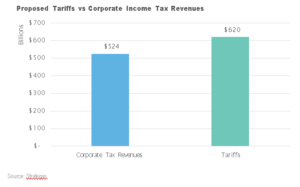

Let’s consider a married couple filing jointly who has taxable income of $300,000. For 2022, this places them in the 24% tax bracket, based on tax-year 2023 IRS inflation adjustments.

They can earn an additional $40,100 of taxable income, for a total taxable income of $340,100, before worrying about being bumped into the 32% tax bracket. It would take an additional $131,900 of taxable income, for a total taxable income of $431,900, before they would find themselves in the 35% tax bracket.

Now, let’s assume one of them inherited an IRA with assets worth $200,000, and each year the account, their income and the tax bracket inflation adjustments remain constant.

They can earn an additional $40,100 of taxable income, for a total taxable income of $340,100, before worrying about being bumped into the 32% tax bracket. It would take an additional $131,900 of taxable income, for a total taxable income of $431,900, before they would find themselves in the 35% tax bracket.

Now, let’s assume one of them inherited an IRA with assets worth $200,000, and each year the account, their income and the tax bracket inflation adjustments remain constant.

It would take roughly five years for the couple to deplete the account without being pushed into the next tax bracket. If they begin withdrawals immediately, they could take out $20,000 annually over the 10-year period. After that, they could be forced to take larger sums that would increase their bracket.

There are multiple ways to take the distribution over the 10 years, including distributing up to your next tax bracket until the funds are depleted, taking the distribution in equal installments over the 10 years, or taking a lump sum distribution at the end of 10 years.

Not every distribution strategy yields the same results, so consider the adjacent illustration comparing the last two examples.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal or tax advice. Certain information is based upon third- party data and may become outdated orotherwise superseded without notice. Third-party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. The above scenarios are hypothetical; individuals should speak with a qualified tax professional based on their own circumstances. R-22-4766

by Launch Kits

by Launch Kits