By Daniel Campbell, CFA

Despite a hopeful start, 2022 turned out to be a tumultuous year for financial markets. Last January, the Federal Reserve’s benchmark rate was near zero, mortgages were just over 3% and the 10-year Treasury was yielding a mere 1.5%. Stock markets had returned from their 2020 lows, and although the pandemic hadn’t ended, investors felt confident in the year ahead. But then came a new set of risks:

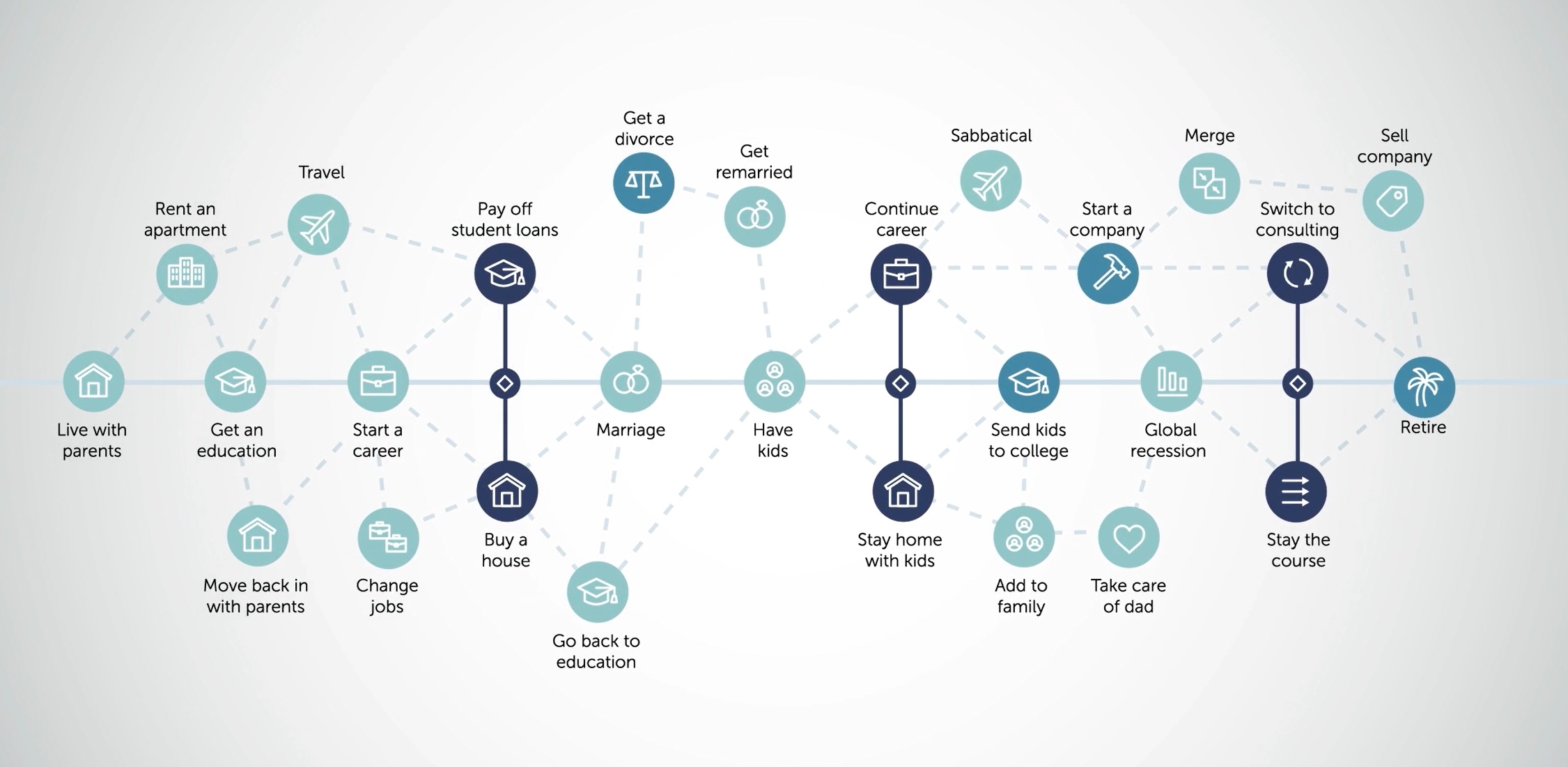

Although the U.S. stock market hit bear market territory in 2022 — a decline of 20% or more from the peak — and the U.S. economy shows signs that we are in a recession, the chart below helps demonstrate why staying invested through tough times is still likely the better path forward for investors . Markets are inherently forward-looking, meaning stocks tend to turn positive long before we officially move out of a recession — a great opportunity for long-term investors. And with the pace of interest rate hikes and inflation expected to moderate, long-term investors have plenty of reasons to be optimistic as we begin a new year.

Data from 1973 – 2021. The market is represented by the CRSP U.S. Total Market Index. Source: Avantis Investors. The average number of months over the period from Peak to

½-Trough and ½-Trough to Trough is 5.4, while the number of months over the period from Trough to ½-Peak and ½-Peak to Peak is 35.9. Past performance is no guarantee of future results.

For informational and educational purposes only. The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Wealth Partners®. This article is for general information only and is not intended to serve as specific financial, accounting or tax advice. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio nor do indices represent results of actual trading. Information from sources deemed reliable, but its accuracy cannot be guaranteed. R-22-4764

by Launch Kits

by Launch Kits