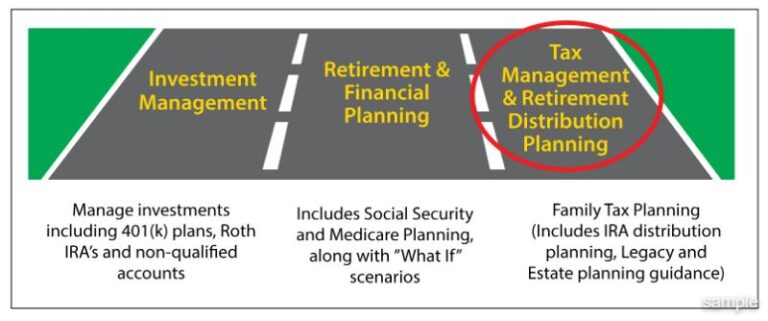

Our Services

Tax-Efficient Strategies

Tax strategy is forward-looking. It focuses on decisions you make today that affect how much you pay in taxes over your lifetime.

We incorporate tax-efficient strategies into financial planning and investment management. We do not prepare or file tax returns. Instead, we review your return alongside your accounts, and long-term goals to identify opportunities to reduce taxes over time and can coordinate those strategies with your CPA.

What We Mean By Tax Strategy

Tax strategy looks ahead. It evaluates how today’s choices affect future tax brackets, cash flow, and flexibility.

We use projections and scenario analysis to understand how decisions such as Roth contributions and conversions, investment sales, charitable giving, or changes in filing status may affect your taxes over time. This work complements your separate tax preparation.

Common areas where tax strategy plays a meaningful role include:

• Coordinating withdrawal strategies to balance RMDs, IRMAA exposure, and legacy goals

• Locating assets across account types to improve after-tax returns

• Evaluating whether Roth conversions make sense and, if so, how to sequence them

• Planning around the higher tax burden faced by surviving spouses

• Adjusting strategies as tax laws and thresholds change

• Aligning tax decisions with estate and wealth transfer planning under the SECURE Act

Why a Tax Strategy Matters

Taxes shape how much income you can take, how long your money lasts, and how much flexibility you have over time. When tax decisions are made one year at a time, they often solve a short-term issue while quietly increasing long-term costs.

As retirement approaches, the window for meaningful course correction narrows. Decisions around account types, withdrawal order, Social Security timing, and Roth conversions become harder to unwind once income sources are set and required distributions begin.

Without a coordinated tax strategy, retirement income, investment gains, and required minimum distributions can unintentionally push taxable income higher, triggering avoidable lifetime taxes and higher Medicare premiums. By addressing these issues earlier and revisiting them over time, tax considerations can be aligned with retirement income planning rather than working against it.

A thoughtful tax strategy helps manage income deliberately, preserve flexibility, and reduce surprises so your financial plan remains durable throughout retirement.

Understanding your return equips us to have more valuable and actionable conversations with you.

Tax strategy plays a role well before retirement through decisions about which accounts to fund, how income is taxed along the way, and how future flexibility is created. It becomes even more important in the years leading up to and during retirement, when tools such as Roth conversions, charitable strategies, and withdrawal sequencing can materially affect long-term outcomes.

Who Is This For?

Tax-efficient strategies are most valuable for households with multiple income sources, growing investment accounts, or upcoming transitions such as retirement, business sales, or the loss of a spouse.

Our clients are typically concerned less with this year’s refund and more with long-term outcomes like lifetime tax exposure, retirement income stability, Medicare premiums, and wealth transfer.