Wealth Management

What is Wealth Management?

Worthen Financial Advisors delivers holistic Wealth Management that includes both Investment Management and Financial Planning. We work with you to design, implement, and monitor your financial plan.

Investment Management

Your advisor will form a robust investment plan to guide you (and us) as we build and maintain your portfolio that aligns with your risk tolerance and goals.

Our portfolios primarily consist of low cost, diversified, tax efficient mutual funds and ETF’s, ranging from Defensive (80% fixed income / 20% equities) all the way to Highly Aggressive (0% fixed income / 100% equities).

Financial Planning

Your financial plan is as individual as you. Incorporating the assessment areas below allows a thorough analysis and a refined focus of your plan so that we can assist you in reaching your personal goals and objectives. Your plan will be regularly updated during our Strategic Planning Meetings to ensure it keeps pace with your life.

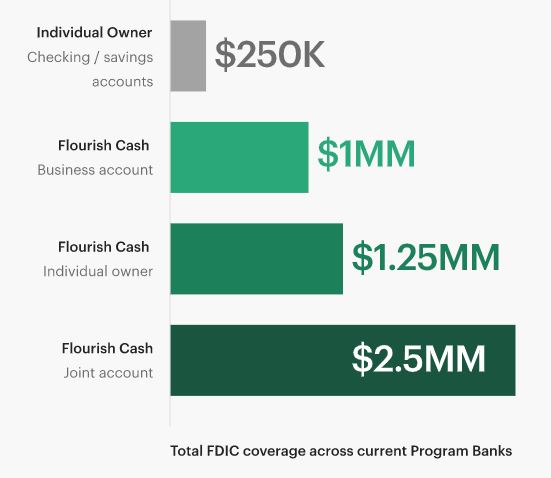

Cash Flow Analysis and Debt Management

A review of income and expenses may be conducted to determine your current surplus or deficit. Based on the results, we might recommend prioritizing how any excess should be used or how to reduce expenses if they exceed income. In addition, advice on the prioritization of debts to repay may be provided based upon factors such as the debt’s interest rate and any income tax ramifications. Recommendations may also be made regarding the appropriate level of cash reserves for emergencies and other financial goals. These recommendations are based upon a review of cash accounts (such as money market funds) for such reserves and may include strategies to save desired reserve amounts.

Risk Management

A risk management review includes an analysis of exposures to significant risks that could adversely impact your financial picture, such as premature death, disability, property and casualty losses, or the need for long-term care planning. Advice may be provided on ways to minimize such risks and weigh the costs of purchasing insurance versus the benefits of doing so and, likewise, the potential cost of not purchasing insurance (“self-insuring”).

Employee Benefits

A review is conducted, and an analysis is made as to whether you, as an employee, are taking maximum advantage of your employee benefits. We will also offer advice on your employer-sponsored retirement plan, deferred compensation, stock options, along with other benefits that may be available.

Retirement Planning

Retirement planning services typically include projections on the likelihood of achieving a financial goal(s), with financial independence usually the primary objective. For situations where projections show less than the desired results, a recommendation may include displaying the impact on those projections by changing certain variables (i.e., working longer, saving more, spending less, taking more risks with investments). Suppose you are near retirement or already retired. In that case, advice may be given on appropriate distribution strategies to minimize the likelihood of running out of money or having to alter spending during retirement years adversely.

Education Planning

Advice may include projecting the amount needed to achieve post-secondary education funding goals, savings strategies, and the “pros-and-cons” of various college savings vehicles available.

Tax Planning Strategies

Advice may include ways to minimize current and future income taxes as a part of the overall financial planning picture. For example, recommendations may be offered as to which type of account(s) or specific investments should be owned based in part on your “tax efficiency,” with consideration that there is always a possibility of future changes to federal, state, or local tax laws and rates that may impact a person’s situation.

Estate Planning and Charitable Giving

Our review typically includes an analysis of your exposure to estate taxes and your current estate plan, including whether you have a will, powers of attorney, trusts, and other related documents. We may assess ways to minimize or avoid estate taxes by implementing appropriate estate planning and charitable giving strategies.

by Launch Kits

by Launch Kits