Our Services

Investment Management

Our firm will form a robust investment plan to guide you (and us) as we build and maintain your portfolio that aligns with your risk tolerance and specific goals.

Our portfolios primarily consist of low cost, diversified, tax efficient mutual funds, ETF’s and individual bonds, and range from Defensive (80% fixed income / 20% equities) all the way to Highly Aggressive (0% fixed income / 100% equities).

Learn more about our Evidence-Driven Investment philosophy here.

The Research Behind Portfolio Strategy

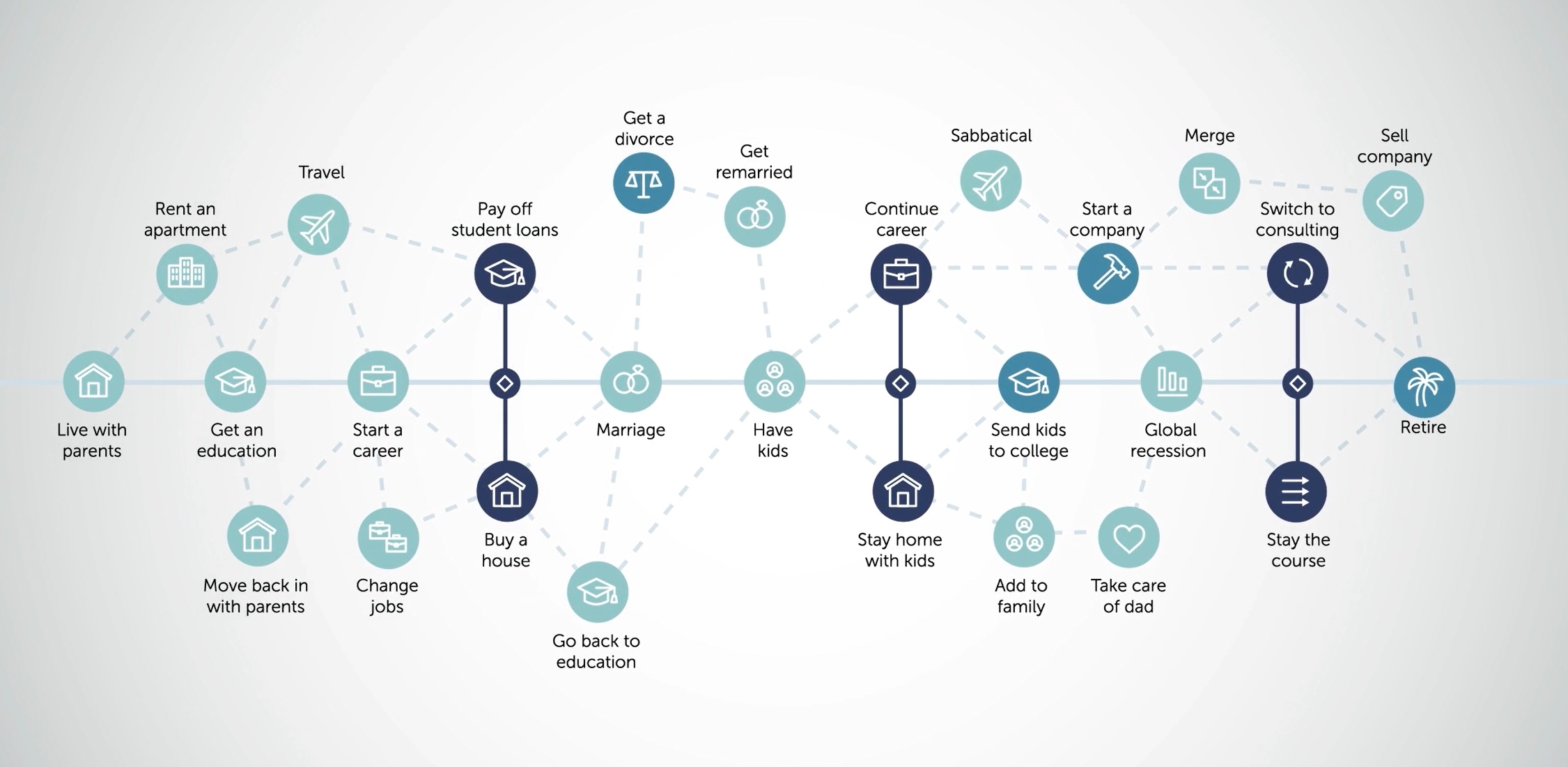

Your investment portfolio is the engine of your financial journey – it helps move you down the path towards your long-term goals. Each piece plays an important role in reaching the outcomes you desire.

Whether you need help growing your wealth or protecting it, the evidence-driven approach involves designing your portfolio so that each investment has unique characteristics and will react differently to economic, political and societal influences. This is part of the diversification process and it’s one way to use research rather than guesswork.

More Than Comfort. Your Team Can Provide Real Value.

The average investor earns significantly less than the funds in which they invest. That doesn’t have to be you.

Over the years, a number of research studies have measured the difference between reported fund performance compared to actual investor performance. Why is there a difference? Investors often buy into a fund after a winning streak (at high prices) and sell when they get nervous (at lower prices). Buying high and selling low is not an optimal strategy, but that is what so many investors do when they let their emotions drive decision-making.

The evidence-driven approach seeks to close that gap. Our role is to keep you focused on the long-term and minimize the inevitable emotional ups and downs that can affect the performance of your investments.

by Launch Kits

by Launch Kits