Lately, we’ve seen a meaningful uptick in market volatility fueled by economic instability here and abroad. From Chinese real estate woes threatening to disrupt their economy, to political wrangling in Washington that will continue to ripple through our own, there’s no escaping that the headlines have near-term market impacts around the world. But if the ups and downs have you worrying, don’t forget—you’ve trained for this! And if you’re working with Worthen Financial Advisors, your portfolio is built with these perfectly normal market cycles in mind.

We Knew It Was Coming

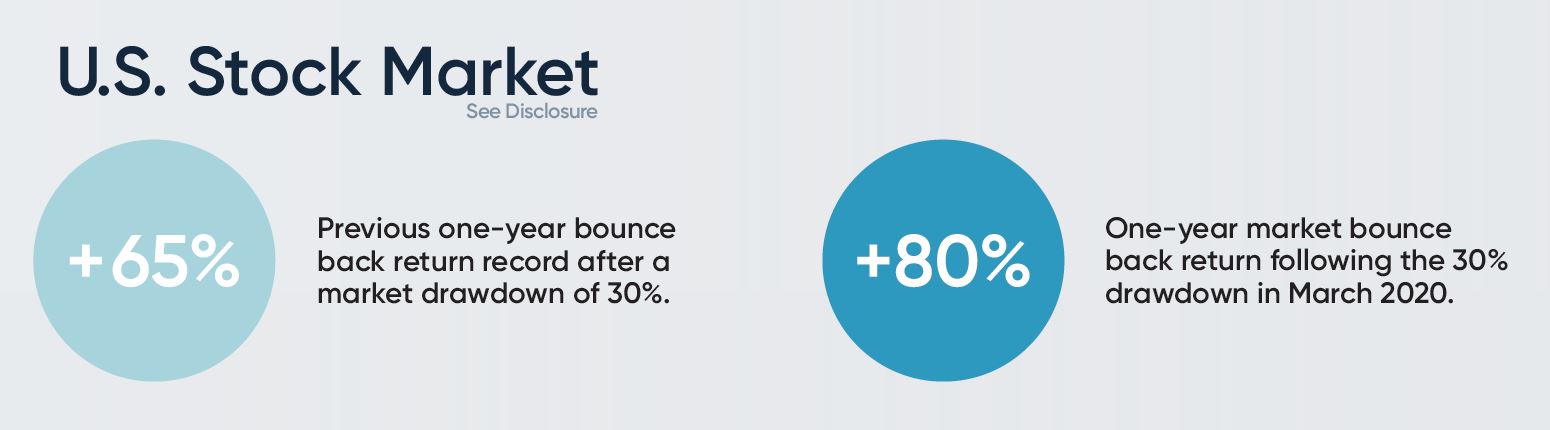

Like an experienced distance runner who knows obstacles and difficulties are simply part of the path ahead, as investors, we know volatility is to be expected. We have just experienced the most robust market bounce back ever in the year following a market meltdown—and it’s important to keep that in perspective when the ups and downs continue.

The above returns reflect a 1-year time period (252 trading days) following a U.S. total market drawdown of 30%. On March 16, 2020, the market had declined 30% from its peak. From March 17, 2020 to March 16, 2021, the U.S. total market returned +80%.

We Prepared for the Inevitability—and Discomfort

History tells us when it comes to the market that what goes up is likely to come down eventually—market corrections and volatility are to be expected in periods following historically high returns. However, simply anticipating market reactions doesn’t make them any easier to endure when they show up—just ask a runner who is unprepared for a hilly race course! Working with an advisor who will implement an evidence-driven, thoroughly diversified, and cost-conscious portfolio tailored to your risk tolerance is like getting in peak shape before a big race. It helps us get ready for whatever is ahead, even—and especially—when it’s uncomfortable.

We Adjust What We Can

You get it by now—investing is a marathon not a sprint. Success is measured not by our performance in any one mile of the race but in whether we cross the finish line and achieve our end financial goal. But that doesn’t mean a little tweaking over time isn’t necessary—something we’re reminded of when volatility is front and center like it has been recently. Throughout the year, work with your advisor to focus on what you can control.

Has a life event triggered a change in risk tolerance? Is it time to reconsider your allocation? Is it time to make changes in other areas of your financial plan? When we’ve prepared all we can and make thoughtful adjustments along the way, we know we’ll be able to handle whatever ups and downs the market gives us and feel good knowing we have the endurance to reach our own finish line. 1

Market Volatility In Context

Most all years the stock market experiences a large intra-year decline. Thus, volatility is the norm. The current drawdown, while painful and significant, is well outside some of the worst historical drawdowns the U.S. market has experienced.

More often than not, the U.S. market has tended to do well in the year following a 20% drawdown, increasing on average by 12% over the next year. There is a wide range of outcomes in that experience, however, with the best performance after a 20% drawdown of +73% recovery and the worst another 44% decline.

Compared to the U.S. stock market drawdown, the U.S. bond market drawdown is more historically notable — essentially the worst period in the modern history of the U.S. bond market. Similar to the stock market, however, bond markets do tend to do well following large drawdowns.

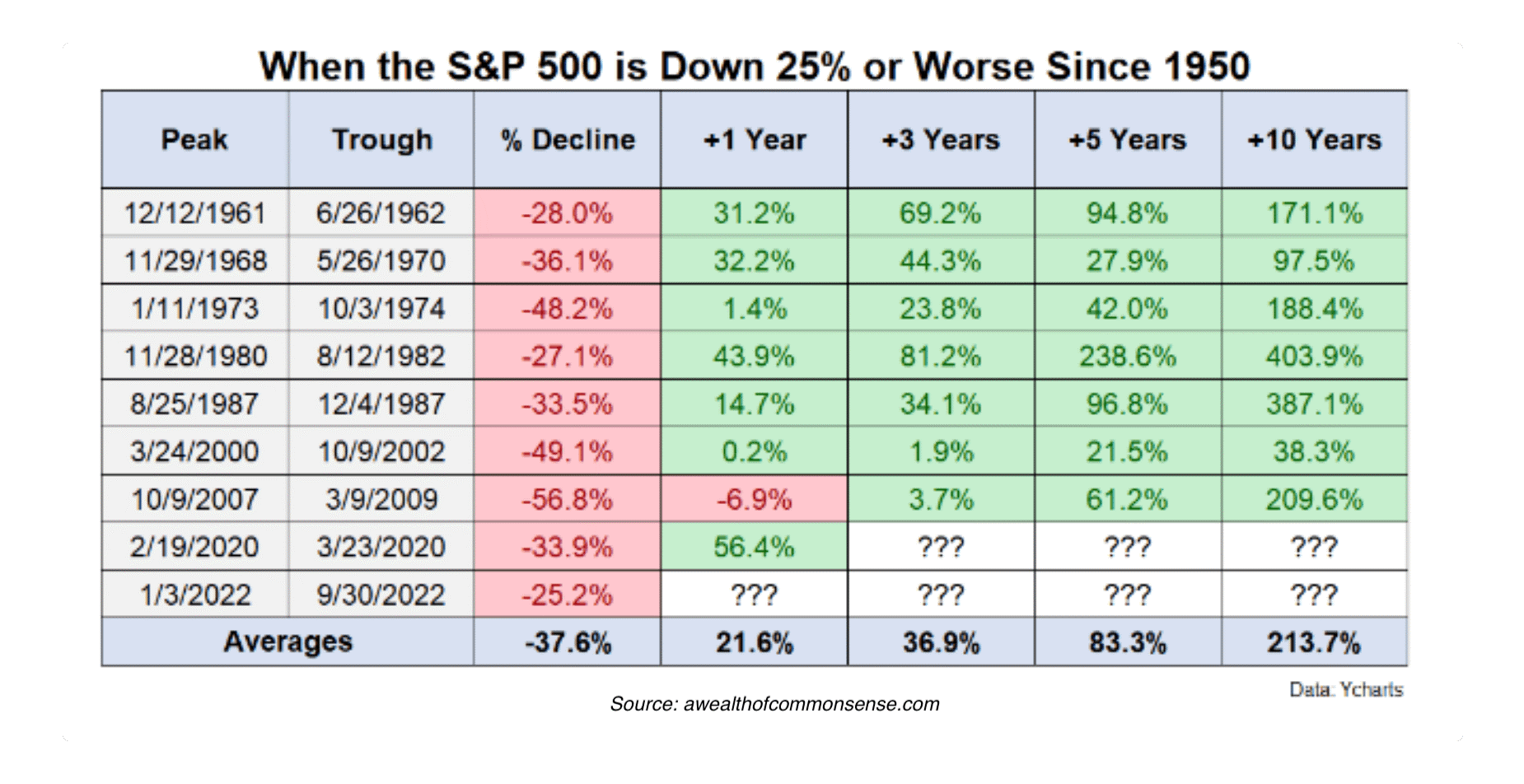

Consider this chart illustrating how double-digit downturns have historically been followed by very healthy returns.

When Will The Bear Market End?

As stocks and bonds continue to tumble a week after the Federal Reserve’s latest rate hike, investors are understandably asking how long this painful bear market will persist.

“It’s been a difficult year, and the pain may continue,” says Capital Group economist Darrell Spence. “But it’s important to keep in mind: One of the things that all past bear markets have had in common is that they eventually ended. Ultimately, the economy and the markets righted themselves.”

While past market results are not predictive of future results, it can be constructive to look at history. Based on the trajectory of past downturns, bear markets that were associated with a recession tended to last, on average, about 18 months, Spence notes. So it wouldn’t be unusual for this one to continue well into 2023.

1 Source: Ken French’s Data Library. U.S. Stock Market is the market-capitalization rate of all CRSP firms incorporated in the U.S. and listed on the NYSE, AMEX, or NASDAQ. U.S. Analysis is based on daily returns since July 1, 1926. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio nor do indices represent results of actual trading. This article is for informational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based off third party data which may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. © 2021 Buckingham Wealth Partners. Buckingham Strategic Wealth, LLC, & Buckingham Strategic Partners, LLC (Collectively, Buckingham Wealth Partners) IRN-21-2763

The Market is Crashing! What Should I Do?

Lately, we’ve seen a meaningful uptick in market volatility fueled by economic instability here and abroad. From Chinese real estate woes threatening to disrupt their economy, to political wrangling in Washington that will continue to ripple through our own, there’s no escaping that the headlines have near-term market impacts around the world. But if the ups and downs have you worrying, don’t forget—you’ve trained for this! And if you’re working with Worthen Financial Advisors, your portfolio is built with these perfectly normal market cycles in mind.

We Knew It Was Coming

Like an experienced distance runner who knows obstacles and difficulties are simply part of the path ahead, as investors, we know volatility is to be expected. We have just experienced the most robust market bounce back ever in the year following a market meltdown—and it’s important to keep that in perspective when the ups and downs continue.

The above returns reflect a 1-year time period (252 trading days) following a U.S. total market drawdown of 30%. On March 16, 2020, the market had declined 30% from its peak. From March 17, 2020 to March 16, 2021, the U.S. total market returned +80%.

We Prepared for the Inevitability—and Discomfort

History tells us when it comes to the market that what goes up is likely to come down eventually—market corrections and volatility are to be expected in periods following historically high returns. However, simply anticipating market reactions doesn’t make them any easier to endure when they show up—just ask a runner who is unprepared for a hilly race course! Working with an advisor who will implement an evidence-driven, thoroughly diversified, and cost-conscious portfolio tailored to your risk tolerance is like getting in peak shape before a big race. It helps us get ready for whatever is ahead, even—and especially—when it’s uncomfortable.

We Adjust What We Can

You get it by now—investing is a marathon not a sprint. Success is measured not by our performance in any one mile of the race but in whether we cross the finish line and achieve our end financial goal. But that doesn’t mean a little tweaking over time isn’t necessary—something we’re reminded of when volatility is front and center like it has been recently. Throughout the year, work with your advisor to focus on what you can control.

Has a life event triggered a change in risk tolerance? Is it time to reconsider your allocation? Is it time to make changes in other areas of your financial plan? When we’ve prepared all we can and make thoughtful adjustments along the way, we know we’ll be able to handle whatever ups and downs the market gives us and feel good knowing we have the endurance to reach our own finish line. 1

Market Volatility In Context

Most all years the stock market experiences a large intra-year decline. Thus, volatility is the norm. The current drawdown, while painful and significant, is well outside some of the worst historical drawdowns the U.S. market has experienced.

More often than not, the U.S. market has tended to do well in the year following a 20% drawdown, increasing on average by 12% over the next year. There is a wide range of outcomes in that experience, however, with the best performance after a 20% drawdown of +73% recovery and the worst another 44% decline.

Compared to the U.S. stock market drawdown, the U.S. bond market drawdown is more historically notable — essentially the worst period in the modern history of the U.S. bond market. Similar to the stock market, however, bond markets do tend to do well following large drawdowns.

Consider this chart illustrating how double-digit downturns have historically been followed by very healthy returns.

When Will The Bear Market End?

As stocks and bonds continue to tumble a week after the Federal Reserve’s latest rate hike, investors are understandably asking how long this painful bear market will persist.

“It’s been a difficult year, and the pain may continue,” says Capital Group economist Darrell Spence. “But it’s important to keep in mind: One of the things that all past bear markets have had in common is that they eventually ended. Ultimately, the economy and the markets righted themselves.”

While past market results are not predictive of future results, it can be constructive to look at history. Based on the trajectory of past downturns, bear markets that were associated with a recession tended to last, on average, about 18 months, Spence notes. So it wouldn’t be unusual for this one to continue well into 2023.

1 Source: Ken French’s Data Library. U.S. Stock Market is the market-capitalization rate of all CRSP firms incorporated in the U.S. and listed on the NYSE, AMEX, or NASDAQ. U.S. Analysis is based on daily returns since July 1, 1926. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio nor do indices represent results of actual trading. This article is for informational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based off third party data which may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. © 2021 Buckingham Wealth Partners. Buckingham Strategic Wealth, LLC, & Buckingham Strategic Partners, LLC (Collectively, Buckingham Wealth Partners) IRN-21-2763

Advisory services are offered through Worthen Financial Advisors, Inc.; an investment adviser domiciled in the state of Texas. This communication is not to be directly or indirectly interpreted as a solicitation of investment advisory services to residents of another jurisdiction unless the firm and the sender of this message are registered and/or licensed in that jurisdiction, or as otherwise permitted by statute.

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Worthen Financial Advisors, Inc[“Worthen”]), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

Worthen is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this video serves as the receipt of, or as a substitute for, personalized investment advice from Worthen. Please remember that it remains your responsibility to advise Worthen, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement.

Related Posts

History Often Repeats Itself in Investing

Does Planning End at Retirement?

10 Attributes of a Great Financial Advisor

Private Equity and the Fear of Missing Out

Worthen Client Spotlight: William & Merrilee W

You might also enjoy

Market Update: The Trump Tariff Strategy

Worthen Client Spotlight: William & Merrilee W

Cybersecurity – Easy Steps to Monitor & Protect Your Assets