By Daniel Campbell, CFA

What are the main issues that could affect your investment portfolio?

You can expect plenty of discussions around Joe Biden’s handling of the pandemic, the response to Russia’s invasion of Ukraine and our current economic landscape. With the Federal Reserve reiterating its intent for further interest-rate hikes to quell historically high inflation, voters will likely be tuned into how each party plans to handle the precarious position of our economy.

Should you reposition your portfolio to take advantage of the changing

agenda in Washington?

An applicable saying is that there’s nothing new in investing, just investment history we don’t yet know. Before making any changes to your portfolio, consider that history teaches us to expect the president’s party to lose seats during midterm elections. So, we can reasonably assume this expectation is baked into stock prices, and we shouldn’t bank on huge swings if Democrats lose seats in Congress.

Is there any pattern between a change in the control of Congress and

future returns in the market?

On average, we’ve seen positive returns for U.S. stocks during years when Republicans controlled Congress, when Democrats controlled Congress and when Congress was split. Over the last 90 years, elections that led to a change in power in either the House or Senate have been followed by a positive year in the stock market each time. Although headwinds to the growth of U.S. stocks will likely continue over the next few years (like high valuations, rising cost of debt and tighter budgets for consumers), the impact of a change in control of Congress isn’t high on that list.

So, what should you do with your portfolio?

Stick to your plan. Everyone wants to see their portfolio grow, but most investors fail not during times of growth, but by panic selling when their portfolio starts to decline. If you are concerned about the volatility in stocks or the higher cost of living, speak with your advisor about investment strategies that can help mitigate these risks. Your portfolio may already be positioned to address them. But evidence shows that trying to guess what the stock market will do before and after elections is not an optimal strategy.

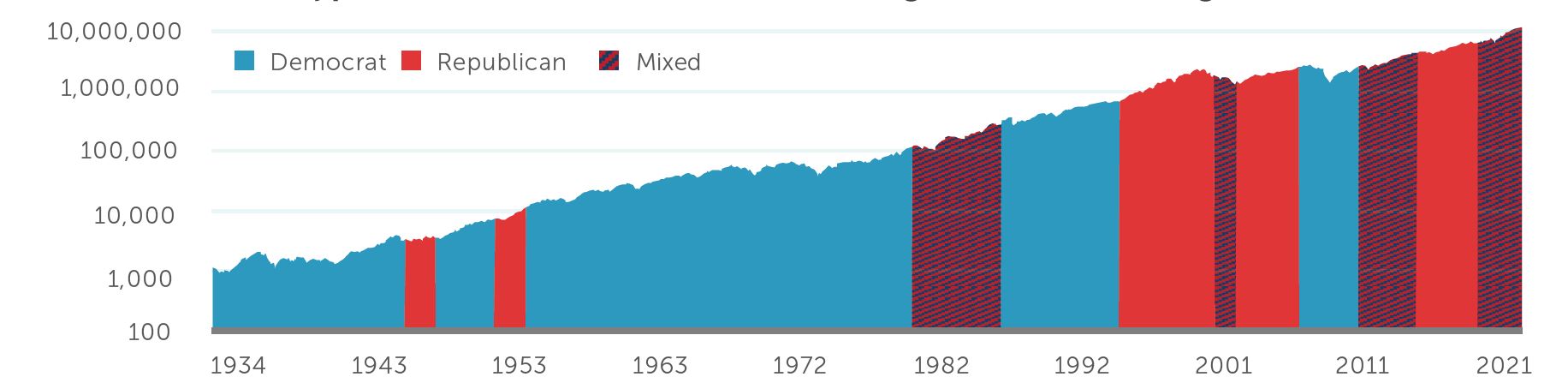

Hypothetical Growth of $1,000 Through Control of Congress100 1,000 10,000 100,000 1,000,000 10,000,000

1934 1943 1953 1963 1972 1982 1992 2001 2011 2021 Your

Portfolio And Midterm Elections: Democrat Republican Mixed

U.S. Market is a value weighted return of all CRSP firms incorporated in the U.S. and listed on the NYSE, AMEX, or NASDAQ. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio nor do indices represent results of actual trading. Information from sources deemed reliable, but its accuracy cannot be guaranteed. Performance is historical and does not guarantee future results. Total return includes reinvestment of dividends and capital gains. Source: Ken French Data Library, house.gov and senate.gov. The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Wealth Partners®. This article is for general information only and is not intended to serve as specific financial, accounting or tax advice.

© 2022 Buckingham Wealth Partners. Buckingham Strategic Wealth, LLC & Buckingham Strategic Partners, LLC (Collectively, Buckingham Wealth Partners) IRN 22-4358

Your Portfolio and Midterm Elections: Key Questions Answered

By Daniel Campbell, CFA

What are the main issues that could affect your investment portfolio?

You can expect plenty of discussions around Joe Biden’s handling of the pandemic, the response to Russia’s invasion of Ukraine and our current economic landscape. With the Federal Reserve reiterating its intent for further interest-rate hikes to quell historically high inflation, voters will likely be tuned into how each party plans to handle the precarious position of our economy.

Should you reposition your portfolio to take advantage of the changing

agenda in Washington?

An applicable saying is that there’s nothing new in investing, just investment history we don’t yet know. Before making any changes to your portfolio, consider that history teaches us to expect the president’s party to lose seats during midterm elections. So, we can reasonably assume this expectation is baked into stock prices, and we shouldn’t bank on huge swings if Democrats lose seats in Congress.

Is there any pattern between a change in the control of Congress and

future returns in the market?

On average, we’ve seen positive returns for U.S. stocks during years when Republicans controlled Congress, when Democrats controlled Congress and when Congress was split. Over the last 90 years, elections that led to a change in power in either the House or Senate have been followed by a positive year in the stock market each time. Although headwinds to the growth of U.S. stocks will likely continue over the next few years (like high valuations, rising cost of debt and tighter budgets for consumers), the impact of a change in control of Congress isn’t high on that list.

So, what should you do with your portfolio?

Stick to your plan. Everyone wants to see their portfolio grow, but most investors fail not during times of growth, but by panic selling when their portfolio starts to decline. If you are concerned about the volatility in stocks or the higher cost of living, speak with your advisor about investment strategies that can help mitigate these risks. Your portfolio may already be positioned to address them. But evidence shows that trying to guess what the stock market will do before and after elections is not an optimal strategy.

Hypothetical Growth of $1,000 Through Control of Congress100 1,000 10,000 100,000 1,000,000 10,000,000

1934 1943 1953 1963 1972 1982 1992 2001 2011 2021 Your

Portfolio And Midterm Elections: Democrat Republican Mixed

U.S. Market is a value weighted return of all CRSP firms incorporated in the U.S. and listed on the NYSE, AMEX, or NASDAQ. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio nor do indices represent results of actual trading. Information from sources deemed reliable, but its accuracy cannot be guaranteed. Performance is historical and does not guarantee future results. Total return includes reinvestment of dividends and capital gains. Source: Ken French Data Library, house.gov and senate.gov. The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Wealth Partners®. This article is for general information only and is not intended to serve as specific financial, accounting or tax advice.

© 2022 Buckingham Wealth Partners. Buckingham Strategic Wealth, LLC & Buckingham Strategic Partners, LLC (Collectively, Buckingham Wealth Partners) IRN 22-4358

Advisory services are offered through Worthen Financial Advisors, Inc.; an investment adviser domiciled in the state of Texas. This communication is not to be directly or indirectly interpreted as a solicitation of investment advisory services to residents of another jurisdiction unless the firm and the sender of this message are registered and/or licensed in that jurisdiction, or as otherwise permitted by statute.

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Worthen Financial Advisors, Inc[“Worthen”]), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

Worthen is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this video serves as the receipt of, or as a substitute for, personalized investment advice from Worthen. Please remember that it remains your responsibility to advise Worthen, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement.

Related Posts

5 Common Questions About Worthen Financial Advisors

For Portfolio Diversification, Bonds Never Go Out of Fashion

Courage! We have been here before

Worthen Client Spotlight: John

The Value of Maximizing Social Security

You might also enjoy

Market Update: The Trump Tariff Strategy

Worthen Client Spotlight: William & Merrilee W

Cybersecurity – Easy Steps to Monitor & Protect Your Assets