By Daniel Campbell, CFA

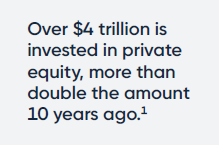

For reality TV fans, one might argue that the private equity world truly took off last year: celebrity Kim Kardashian launched her own private equity firm. As these investments get more media attention, some investors are wondering if this would be a good addition to their portfolio. Although we continue to evaluate this evolving space, the high valuations give us concern on whether this is the time to add private equity to our portfolios.

What is private equity?

Private equity involves investing in companies that are not publicly traded. Most commonly, a private equity firm, known as the general partner, will supplement cash from outside investors with debt to purchase existing public companies, or portions of companies, and take them private through a leveraged buyout. The general partner will set up a new fund every few years, and the group of investors, known as limited partners, commit to staying invested over the fund’s life, usually 10 years or longer. Over that time, the general partner uses the capital to buy companies, increase their value and then sell them for a return.

What are the possible benefits?

• Private equity allows access to an area of the market that is otherwise inaccessible to individual investors – companies not on a public stock exchange.

• Private equity appears to have high, stable returns for individual investors as well.

What are the possible risks?

• Private equity general partners determine the value of held companies, and research shows that their price adjustments tend to lag those of public stock markets.2 In other words, the price stability is mostly contrived.

• The returns for both public and private companies are driven by a similar set of underlying risks, and the returns for an individual investor will be highly dependent upon when they start investing and the general partner they choose.

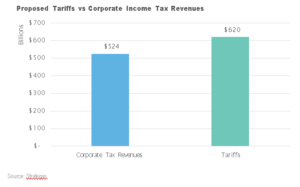

• Competition has intensified over the last decade, leading to higher valuations and lower estimates of future returns for investors. One study found that private equity deals made in 2021 were done at a 10% premium to the S&P 500, more than double the value of deals done in 2010.3

• Private equity investments are highly illiquid, meaning investors are generally unable to sell their holdings for the full value before the end of the fund’s life (if they can sell at all).

• Research shows that once you adjust private equity returns for risks, most private equity funds have not provided higher risk-adjusted returns. Rather, the returns look like that of a levered investment in small, inexpensive companies with high debt.4

1 Source: Pitchbook. “Global Private Market Fundraising Report.” February 2023.

2 Source: Rabener, Nicolas. “Private Equity Is Still Equity, Nothing Special Here. The Journal of Investing.” December 2020.

3 Source: Dan Rasmussen, Verdad Capital. “Private Equity: Still Overrated and Overvalued?” May 2022.

4 Source: Rabener, Nicolas. “Private Equity Is Still Equity, Nothing Special Here. The Journal of Investing.” December 2020.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based on third-party data and is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third-party data may become outdated or otherwise superseded without notice. Investing in private equity presents unique risks and individuals should speak with their qualified professional based on their own circumstances. Neither the Securites and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article. R-23-5234

© 2023 Buckingham Wealth Partners. Buckingham Strategic Wealth, LLC & Buckingham Strategic Partners, LLC (Collectively, Buckingham Wealth Partners)

by Launch Kits

by Launch Kits