By Jared Kizer, CFA

When it comes to portfolio diversification, the main purpose of fixed income, or bonds, is to protect the wealth you’ve worked hard to accumulate. While stocks provide greater potential for growth, bonds help insulate portfolios from the larger price swings of the stock market.

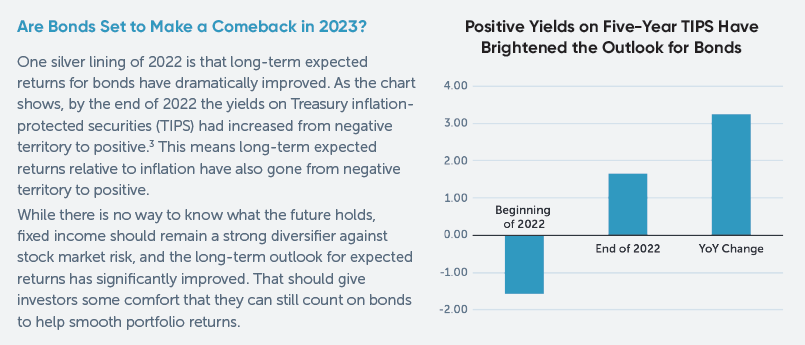

In fact, there’s only been one year since 1970 when both global stocks and five-year U.S. Treasury notes produced negative returns, and that year was 2022.1 So, why did last year prove to be such a challenging one for fixed income investors? The main reason was the significant increase in interest rates – the year-over-year increase in the five-year Treasury rate was the largest in the last 60 years.2 When interest rates go up, bond prices go down.

Although years like 2022 have been rare, naturally they can lead investors to question the value of fixed income within a diversified portfolio. While there is no perfect way to diversify a portfolio, investing in high-credit-quality bonds with relatively short maturity dates is typically the most reliable way to protect the portfolio from the risk that more volatile investments, like stocks, will experience losses.

For example, the most secure and creditworthy bonds are those backed by the U.S. government, which is unlikely to fail to repay investors. And a bond with a shorter maturity date – within one to 10 years – is safer because it is less sensitive to changes in interest rates over its time to maturity.

by Launch Kits

by Launch Kits