By Alex Kluesner

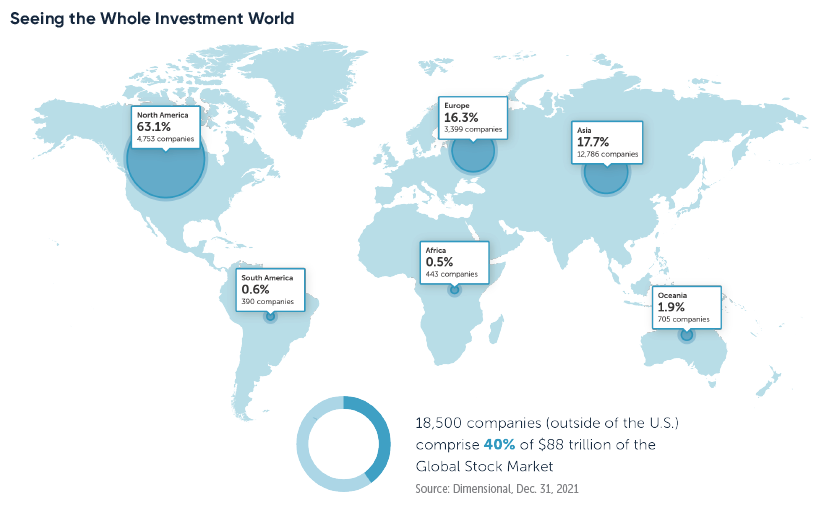

It’s a fair question to ask ourselves: should my portfolio be exposed to foreign companies? The answer is nuanced and investor-specific, but ultimately, yes. Buckingham’s Investment Policy Committee (IPC) believes an allocation in your portfolio to companies outside of the U.S. is beneficial. Let’s look at some of the most common reasons people tend to question their portfolio’s international allocation.

Geopolitical Risk

This risk is front of mind for many investors given that the war in Ukraine has been ongoing for longer than a year and shows little sign of resolution. Geopolitical risks, such as a war or health crisis, can affect global companies – and their stock returns – in many ways, including by creating trade disruptions, slowing the economy and weakening local currencies relative to the U.S. dollar. Last year showed the impact: international stocks faced headwinds as the U.S. dollar had its best run in 20 years, which increases costs and lowers profits for businesses operating overseas.1

Although geopolitical risks can be worrying for investors, we believe there is no reason to react to the latest news because highly efficient markets incorporate all the relevant, known information into today’s stock prices. That’s also the reason why your portfolio isn’t tactically managed around the timing of different market events; by the time you come across new information, it has likely been baked into current prices. In fact, the IPC believes the best strategy to guard your portfolio against geopolitical risk is to own stocks from as many different countries and regions as possible. By doing so, you will be lowering your country-specific risk, both at home and abroad.

International Business by U.S. Companies

Proponents of a U.S.-only stock portfolio argue that it supplies ample exposure to foreign markets through each company’s international revenue streams: according to Morningstar, U.S. companies source approximately 38% of their revenue outside our borders.2 While this would provide some international exposure, we believe it falls short from a total portfolio diversification viewpoint. One of the big benefits of investing in foreign markets is the opportunity to own shares of companies that focus solely on their local markets, such as grocery chains and local restaurants. Studies show that these companies provide greater diversification benefits than multinational companies, which source revenue from their home markets and internationally.3

Also, investing internationally means you own portions of foreign companies that source part of their revenue from the U.S. For example, U.S. consumers provide more than 20% of revenue for companies based in the U.K., Germany, France, Belgium and Taiwan, among others. By not investing internationally, one would forgo the opportunity to take part in the growth and innovation of well-known, multinational companies like LG, Honda, Nestlé, Budweiser and many others.4

Recent U.S. Stock Market Performance

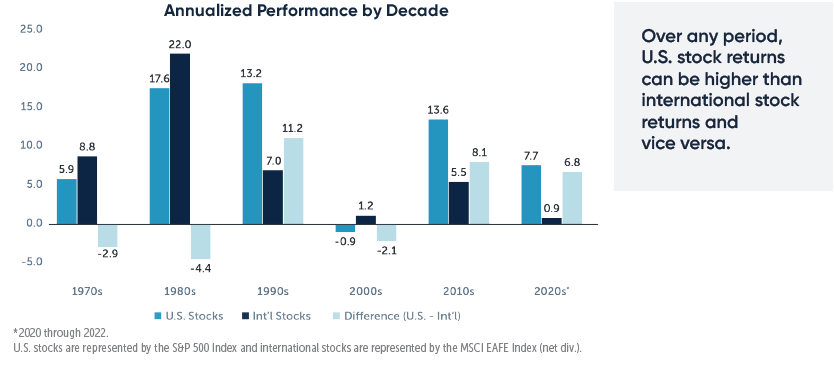

It can be very easy to anchor your expectations to recent performance when evaluating the holdings in your portfolio. Since the 2010s, U.S. stocks have enjoyed a stretch of superior performance compared with their international counterparts. However, this hasn’t always been the case. International stocks outpaced domestic stocks in the 1970s and 1980s. And although that trend reversed in the 1990s, the following decade — known as the “Lost Decade” because U.S. stocks lost value during the period — international stocks posted modest gains. This reinforces the fact that over any period, U.S. stocks can outperform their international counterparts and vice versa. And because market timing is often ill-fated, it’s best to own stocks from all over the world.

Focus on What You Can Control

As investors, we like to think that we can forecast stock market performance with some degree of certainty, but ultimately, global stock market performance is not within our control. Instead, we should focus on the things we can control, such as the types of risk that we take in our portfolios. Taking on international stock market risk in your portfolio provides the potential for diversification benefits, but if this risk makes you feel too uneasy, consult with your trusted advisor to discuss the appropriate level of international stock exposure in your portfolio.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based on third-party data and may become outdated or otherwise superseded without notice. Third-party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article. R-23-5210

by Launch Kits

by Launch Kits