At Worthen Financial Advisors, we work with our clients to determine the right size emergency fund to be held in cash in order to meet unexpected needs. Many of our clients also utilize sinking funds to prepare for expected large expenses, like cars, appliances and home repairs.

We are frequently asked where emergency fund and sinking fund cash can be kept that will earn more than a regular bank savings account while not subjecting the money to market risk. To meet this need, we are thrilled to offer Flourish Cash!

Information about Flourish Cash1

Flourish Cash is designed to help you or your business earn a competitive interest rate on your cash while providing you with access to increased FDIC insurance coverage through our Program Banks,2 all within an account that’s designed for complete ease-of use: no account fees, no minimums, and an unlimited number of transfers.3 Flourish Cash is available by invitation only.

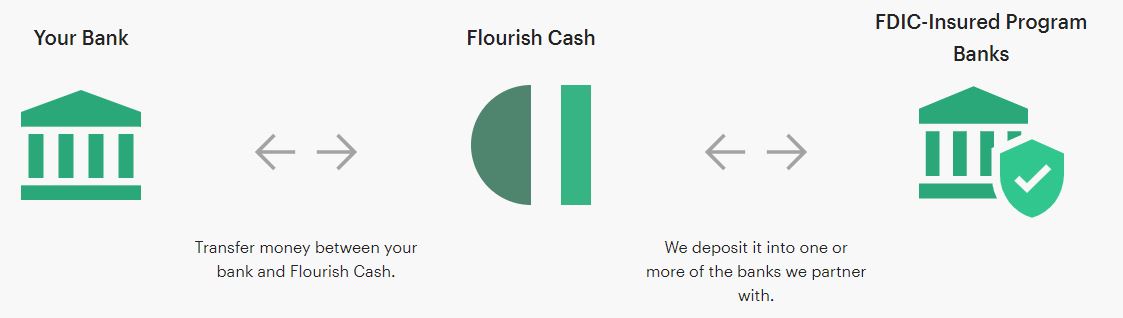

Any money you transfer into your Flourish Cash account will be automatically deposited at select FDIC-member banks,

such as PNC Bank and HSBC Bank USA, through a broker-dealer “sweep program.” This means your cash will receive FDIC insurance coverage as if you had deposited that cash directly with those banks,2 and you can withdraw it whenever you need it.3

Flourish Cash gives you one account that provides:

● A Competitive Interest Rate.4

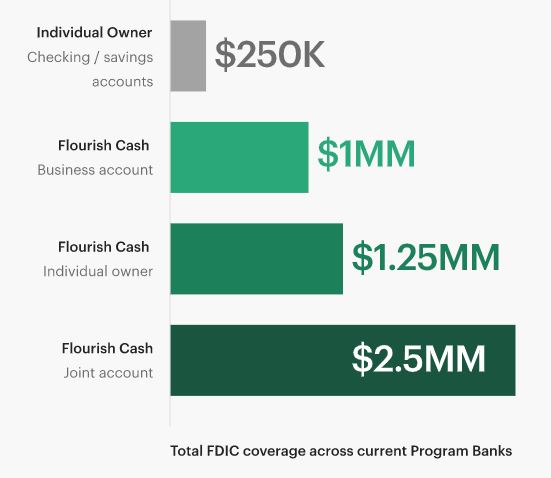

● Keep your cash FDIC Insured: Receive FDIC insurance coverage through our Program Banks of up to $1.25MM for an individual account, $2.5MM for a joint account, and up to $1MM million for a business account.2

● Easily access your cash: transfer money with just a few clicks whenever you need it with an unlimited number of transfers.3

● Zero minimums, zero account fees: Flourish Cash was built for total flexibility, with no minimums and no account fees–all while taking less than five minutes to sign up.

We also provide support for corporations, LLCs, partnerships, and nonprofit organizations through Flourish Cash Institutional. These accounts feature the same great interest rate4 and up to $1MM in FDIC insurance coverage,2 with $0 minimum, zero account fees, an unlimited number of transfers,3 and a completely paperless sign-up process.

1Flourish Cash is a service offered by Flourish Financial LLC, a registered broker-dealer and FINRA member. Flourish Financial LLC is not a bank. If you were introduced or invited to Flourish Cash by a third-party investment adviser or other third party, whose name or logo may be shown above, please be aware that they are not affiliated with Flourish Financial LLC and will not provide any advisory or brokerage services for your Flourish Cash account or have the authority to provide instructions on your account. A Flourish Cash account is a brokerage account offered by Flourish Financial LLC. The cash balance in a Flourish Cash account is swept from the brokerage account to deposit account(s) at one or more third-party banks that have agreed to accept deposits from customers of Flourish Financial LLC (“Program Banks”). The accounts at Program Banks pay a variable rate of interest.

2The cash balance in a Flourish Cash account that is swept to one or more Program Banks is eligible for FDIC insurance, subject to FDIC rules, including FDIC aggregate insurance coverage limits. FDIC insurance will not be provided until the funds arrive at the Program Bank. There are currently at least 6 Program Banks available to accept deposits for institutional Flourish Cash accounts (accounts for corporations, partnerships and other legal entities) and at least 8 Program Banks available to accept deposits for personal Flourish Cash accounts (individual, joint and revocable trust accounts), and we are not obligated to allocate customer funds across more than this number of Program Banks if there is a greater number of banks in the Program. Customers are generally eligible for FDIC insurance coverage of $250,000 per customer, per Program Bank, for each account ownership category. Thus, institutional customers are eligible for up to $1,000,000 of FDIC insurance and personal customers are eligible for (i) up to $1,250,000 of FDIC insurance for either (A) an individual account or (B) an account for a revocable living trust in which one person is the only grantor, trustee and beneficiary of the trust (“Individual Revocable Trust Account”) and (ii) up to $2,500,000 of FDIC insurance for either (A) a joint account with two owners or (B) an account for a revocable living trust in which the same two persons are each the only grantors, trustees and beneficiaries of the trust (“Joint Revocable Trust Account”). The total FDIC coverage for a two-person household is calculated assuming that each household member has an individual account and that both household members share a joint account. If the number of Program Banks decreases for a customer (either because a Program Bank is no longer participating in Flourish Cash, because a customer’s cash is not eligible to be swept to a Program Bank based on criteria set by the Program Bank (which will be disclosed at account opening), or because a customer opts out of having their cash swept to a particular Program Bank), the amount of FDIC insurance for which the customer would be eligible through Flourish Cash would be lower. Typically, all of a customer’s deposits at a Program Bank in the same ownership category (including deposits held outside Flourish Cash or held through multiple Flourish Cash accounts with the same ownership category) count toward the FDIC insurance limit for deposits at that Program Bank. Customers are responsible for monitoring whether they maintain deposits at a Program Bank outside of Flourish Cash and should consider opting out of having their cash swept to any such Program Bank to avoid exceeding FDIC insurance limits. Although Flourish Cash is offered through a brokerage account and cash held in brokerage accounts often has the benefit of SIPC protection, until such time as we offer securities products, customers likely will not have the benefit of SIPC protection for cash held in their Flourish Cash account. Further, SIPC protection is not available for any cash held at the Program Banks. Our current Program Banks can be found here. For additional information regarding FDIC coverage, visit https://fdic.gov.

3For withdrawal requests submitted by the applicable deadline, the funds will generally be transferred to the requested external account by the next business day, except for withdrawal requests submitted on the weekend or on a holiday, which should be completed by the second following business day, but in some circumstances, withdrawals may take longer to complete, as further described in your account agreement.

4Flourish Cash has a tiered interest rate structure, as set forth in the rate tier summary: flourish.com/info/rates We deposit your cash first with one or more of the Program Banks in the tier with the highest interest rate, up to the maximum amount of deposits for that tier, and then continue depositing cash at Program Bank(s) in each successive tier until all cash has been deposited, subject to any Program Bank opt out elections you have made. The Flourish Cash rates may change at any time. The rates of interest paid by the Program Bank(s) to Flourish Cash customers may be lower than the rate that could be earned by you opening a deposit account directly with such bank(s).