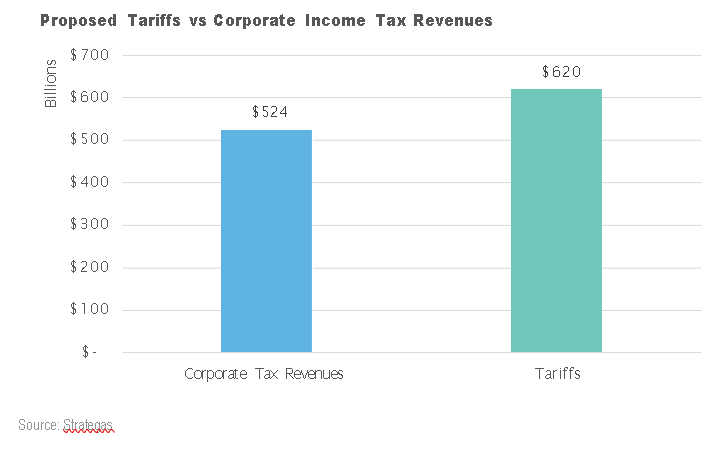

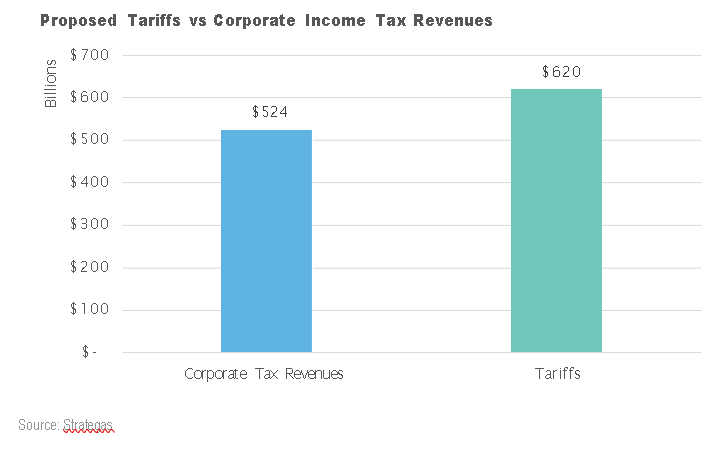

Market Update: The Trump Tariff Strategy

Market Update: The Trump Tariff Strategy

We have been here before and the market, along with our individual investment accounts, have always recovered. Those who stay the course have always been rewarded

Market Update: The Trump Tariff Strategy

We have been here before and the market, along with our individual investment accounts, have always recovered. Those who stay the course have always been rewarded

Today we celebrate our clients William & Merrilee Withers. We’ve asked them to answer some questions about their financial journey in hopes that you can find inspiration from it. About Us Name:

Today we celebrate our clients John. We’ve asked them to answer share some lessons learned and insights about their financial journey with the aim of providing ideas and inspiration to others!

Today we celebrate our clients Jason & Lisa M. We’ve asked them to share some lessons learned and insights about their financial journey with the aim of providing ideas and inspiration to

Today we celebrate our clients Jesse & Casi S. We’ve asked them to share some lessons learned and insights about their financial journey with the aim of providing ideas and inspiration to

By Daniel Campbell, CFA For the first time in over 50 years, both stocks and high-quality bonds were down in 2022. The last time this happened was 1969, and the story is eerily similar to what we just

ByMatt Nelson, MBA, CFP® Planning IRA distributions can be a challenge, especially for non-spouse beneficiaries who inherit the account from a deceased loved one. Making this dilemma even trickier to navigate – as of 2020, most non-spouse beneficiaries

By Jonathan Scheid, CFA, AIF® Higher inflation not only impacts prices for goods and services, but it also influences government program benefits and the taxes we pay. Government officials use a re-calibration system when they pass many laws now, and that

With Thanksgiving in the rearview mirror, many of us are finalizing holiday shopping lists and making end-of-year medical appointments. But it’s also time to think about taxes. Yes, April is still four

Because the administration calculates the cost-of-living adjustment (COLA) based on inflation, we believe this year retirees could see their monthly benefits increase by an estimated 8%-10%—the largest percentage increase since the early

© 2024 All rights reserved