Worthen Client Spotlight: William & Merrilee W

Today we celebrate our clients William & Merrilee Withers. We’ve asked them to answer some questions about their financial journey in hopes that you can find inspiration from it. About Us Name:

Today we celebrate our clients William & Merrilee Withers. We’ve asked them to answer some questions about their financial journey in hopes that you can find inspiration from it. About Us Name:

Today we celebrate our clients John. We’ve asked them to answer share some lessons learned and insights about their financial journey with the aim of providing ideas and inspiration to others!

Today we celebrate our clients Jason & Lisa M. We’ve asked them to share some lessons learned and insights about their financial journey with the aim of providing ideas and inspiration to

Today we celebrate our clients Jesse & Casi S. We’ve asked them to share some lessons learned and insights about their financial journey with the aim of providing ideas and inspiration to

By Anthony Hernandez, CFP® After wrapping up end-of-year reviews, Angela and I found a common theme: A well-crafted budget is a key tool for financial success for families and individuals. This seemingly

https://youtu.be/lKS0-Kv31jc Summary In this video, Angela and Anthony present the Worthen Financial Blueprint, a comprehensive eight-step guide to achieving financial clarity and living happily ever after. They cleverly compare each step to

By Jonathan Scheid, CFA, AIF® Higher inflation not only impacts prices for goods and services, but it also influences government program benefits and the taxes we pay. Government officials use a re-calibration system when they pass many laws now, and that

401(K)s, HSA, 529 Plans, and IRAs are all types of savings vehicles that you may have heard of. What do they all do, and more importantly, how do you know when to

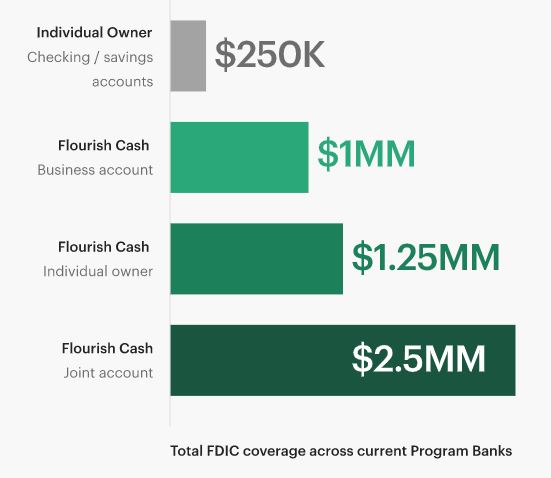

At Worthen Financial Advisors, we work with our clients to determine the right size emergency fund to be held in cash in order to meet unexpected needs. Many of our clients also

Just because nothing has changed for you does not mean you can forego carefully reviewing your enrollment options. It is likely that costs and coverages for your current plan have changed, even

© 2024 All rights reserved