Original article by David McLellan for Kiplinger

I came across an article (see link at the bottom of this page) and want to share it with you, our clients and readers. It is Part 7 of a 7-part series written by David McLellan for Kiplinger.com. All 7 parts are a good read, but this one is particularly important for you if you have not already considered, researched and modeled out how to counteract the Tax Bomb your current portfolio could contain for either you, your heirs, or both.

If you are like many people we talk with, you may think you are too old or too far into retirement to make a change in your retirement distribution plan. I get it! You spent your working years diligently building your nest egg, climbed the Mt. Everest towards retirement, and are now happily enjoying that retirement, perhaps with the same distribution strategies your parents used. However, there are a couple of new items that change the traditional approach of “I’ll take my Required Minimum Distributions and leave what is left to my kids.”

There are 2 new key factors working together to potentially create a “retirement tax bomb” in your retirement plan, both of which are basically a result of the COVID global pandemic.

What are these 2 key factors?

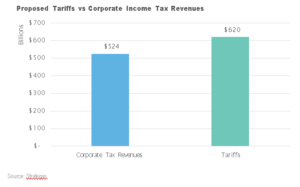

- FOR YOU: The likelihood that tax rates are going up in the future. When considering whether to do a ROTH conversion (or systematic ROTH conversions) and when, a key question is, “Do you believe you are in a higher tax bracket now, or will you be in a higher tax bracket in the future?” The reason for this question is, if you believe you will be in a lower tax bracket in the future, it may not make sense for you to do ROTH conversions. However, McLellan believes (and I agree) that, “Current tax rates are near historical lows and may be the lowest we’ll see for the rest of our lives.” That means most of us will likely be in a higher tax bracket in the future. This makes it important to have a plan for taxes. Part of that plan should be to find out how ROTH conversions may impact your retirement distribution plan and your taxes, both now and in the future.

- FOR YOUR HEIRS: The elimination of the Stretch IRA. For those holding tax deferred retirement accounts (such as Traditional IRA’s, for example), McLellan explains, “Prior to passage of the SECURE Act in 2019, non-spouse heirs typically could calculate RMDs on Inherited IRAs using their own life expectancy, which allowed them to “stretch” out the RMD over a much longer period, perhaps 30 years or more. That’s no longer the case. Under current tax law, heirs have 10 years to fully deplete any inherited IRAs…it still means that most people inheriting IRAs will have significantly fewer years to take their RMDs, meaning significantly more taxable income during that decade. Recall that RMD income from tax-deferred accounts is taxed as ordinary income.”

This acceleration in IRA distribution income is likely to hit your heirs when they are in their peak earning years and their tax rate is already high, making the elimination of the Stretch IRA and introduction of the 10 year rule a potential tax whammy for them.

I don’t know about you, but I haven’t ever talked to anyone whose goal was to leave as much money as possible to…taxes.

ROTH IRA’s are tax free money, not subject to Required Minimum Distributions for you or your heirs.

“Simply put, paying taxes today may be a bargain compared with deferring (and growing) your tax liability into the future.”

This article illustrates how Asset Location and modest ROTH conversions done annually (even until the age of 90), can potentially save a significant amount in taxes for both you and your heirs.

It’s not too late to implement planning strategies “that can dramatically reduce your taxes in retirement and the tax liability you leave your heirs.”

Check out our Free Resources section for these and many other items to consider, such as:

AVOIDING IRMAA SURCHARGES ON MEDICARE PART B & D

WILL A DISTRIBUTION FROM MY ROTH BE TAX AND PENALTY FREE

CAN I DELAY DISTRIBUTIONS FROM THE TRADITIONAL IRA I INHERITED?

by Launch Kits

by Launch Kits