Worthen Client Spotlight: William & Merrilee W

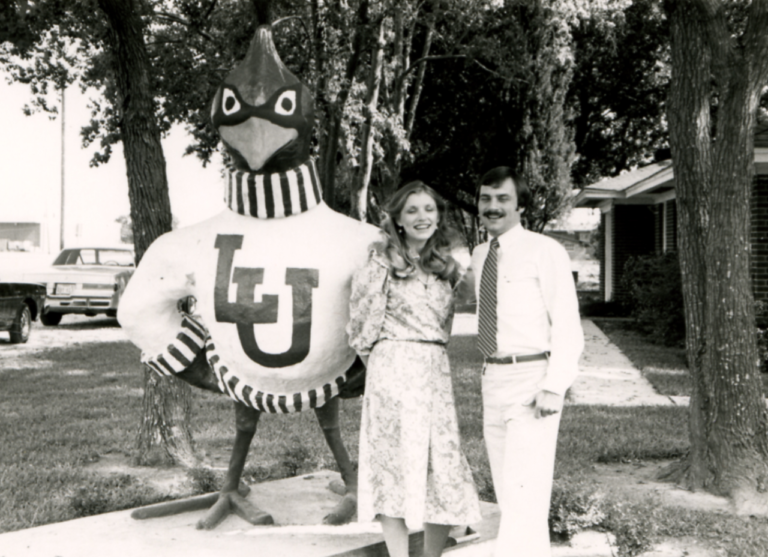

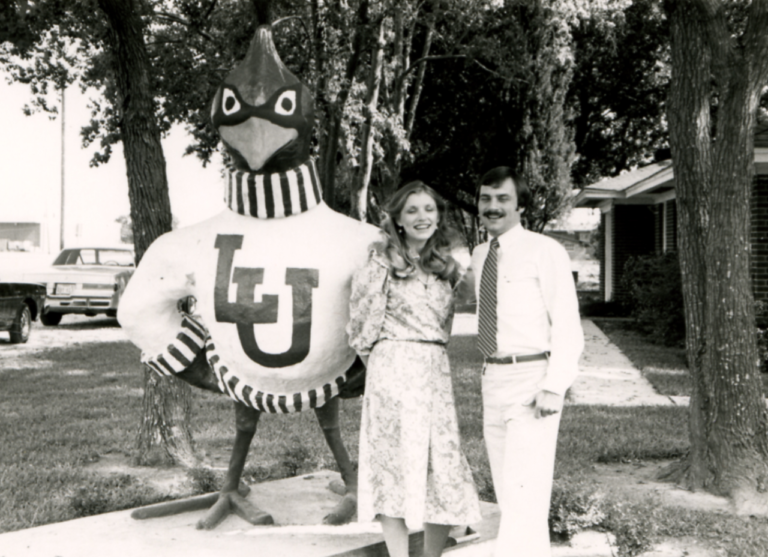

Today we celebrate our clients William & Merrilee Withers. We’ve asked them to answer some questions about their financial journey in hopes that you can find inspiration from it. About Us Name:

Today we celebrate our clients William & Merrilee Withers. We’ve asked them to answer some questions about their financial journey in hopes that you can find inspiration from it. About Us Name:

Today we celebrate our clients John. We’ve asked them to answer share some lessons learned and insights about their financial journey with the aim of providing ideas and inspiration to others!

Today we celebrate our clients Jason & Lisa M. We’ve asked them to share some lessons learned and insights about their financial journey with the aim of providing ideas and inspiration to

We all know the joke about death and taxes. While paying taxes is unavoidable, there are ways to make the process a little less painful. In this workshop we will evaluate and

By Jonathan Scheid, CFA, AIF® Higher inflation not only impacts prices for goods and services, but it also influences government program benefits and the taxes we pay. Government officials use a re-calibration system when they pass many laws now, and that

With Thanksgiving in the rearview mirror, many of us are finalizing holiday shopping lists and making end-of-year medical appointments. But it’s also time to think about taxes. Yes, April is still four

Just because nothing has changed for you does not mean you can forego carefully reviewing your enrollment options. It is likely that costs and coverages for your current plan have changed, even

529 plans are great investment vehicles to save for education expenses while remaining tax-sheltered, when used for qualified expenses. Thanks to the Tax Cuts and Jobs Act of 2017, there are even

Essentially, there are two phases in your adult financial life: accumulation and distribution. From your graduation through the collection of your final earned income paycheck, you are in the accumulation phase, during

© 2024 All rights reserved