Our Services

Wealth Management Services

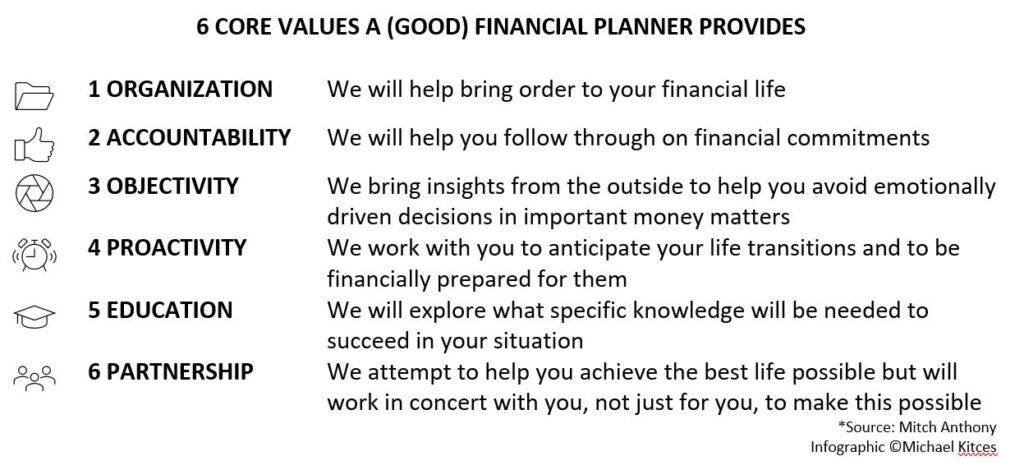

Worthen Financial Advisors offers Wealth Management Services that includes both Financial Planning and Portfolio Management. When you elect this service, you will engage us to design, implement, and monitor a financial plan, and provide ongoing Financial Planning Services and Portfolio Management Services.

As a Wealth Management client, you are assigned a Personal Financial Planner to work with in developing a comprehensive financial plan that addresses both business and personal planning.

Support Documents:

We collect information regularly throughout the year from you that we use to update a personal balance sheet. This balance sheet serves as the basis for regular conversations regarding personal cash flow, financing, large financial transactions, investments, financial health and profitability, personal liquidity and risk management. As your circumstances and goals change, our highly organized system of proactive communication helps to ensure we remain well informed of these changes. You can call, email, or schedule meetings at your discretion.

Depending on the scope of the engagement, you may be asked to provide copies of the following documents early in the process:

- wills, codicils, and trusts

- insurance policies, including information about riders, loans, and amendments

- mortgage information

- tax returns

- student loans

- divorce decree or separation agreement

- current financial specifics including W-2s, 1099s, K-1 statements, etc.

- information on current retirement plans and other benefits provided by an employer

- statements reflecting current investments in retirement and non-retirement accounts

- employment or other business agreements, and

- completed risk profile questionnaires or other forms provided by our firm.

It is important that the information and/or financial statements provided to us are accurate.

Portfolio Management

A critical component of your experience with our firm is the formation of a robust investment plan to guide you (and us) as we build and maintain your portfolio. Our broad process consists of five steps:

Step One: Assessing Goals and Circumstances

The investment planning process begins during the LifeDiscovery meeting with a discussion of financial values and goals, key relationships, existing assets, other professional advisers, preferred process, and important interests. Discovery will be an ongoing part of our relationship.

Step Two: Risk Assessment

Before recommending a particular portfolio strategy, we help you assess your ability, willingness and need to take risk.

Step Three: Understanding the Investment Strategy

We want you to understand our firm’s investment philosophy.

Step Four: Building the Portfolio

Step Five: Ongoing Maintenance

Financial Planning

Your financial plan is as broad-based or narrowly focused as you desire. The incorporation of most or all listed below assessment areas allows not only a thorough analysis but also a refined focus of your plan so that the firm is able to assist you in reaching your goals and objectives. You will receive a written plan in printed or digital format at the end of the process that is tailored to your situation.

Cash Flow Analysis and Debt Management

A review of income and expenses may be conducted to determine your current surplus or deficit. Based upon the results, we might recommend prioritizing how any surplus should be used, or how to reduce expenses if they exceed income. In addition, advice on the prioritization of which debts to repay may be provided, based upon such factors as the debt’s interest rate and any income tax ramifications. Recommendations may also be made regarding the appropriate level of cash reserves for emergencies and other financial goals. These recommendations are based upon a review of cash accounts (such as money market funds) for such reserves and may include strategies to save desired reserve amounts.

Risk Management

A risk management review includes an analysis of exposures to major risks that could have a significant adverse impact on your financial picture, such as premature death, disability, property and casualty losses, or the need for long-term care planning. Advice may be provided on ways to minimize such risks and about weighing the costs of purchasing insurance versus the benefits of doing so and, likewise, the potential cost of not purchasing insurance (“self-insuring”).

Employee Benefits

A review is conducted, and analysis is made as to whether you, as an employee, are taking maximum advantage of your employee benefits. We will also offer advice on your employer-sponsored retirement plan, deferred compensation, stock options, along with other benefits that may be available.

Personal Retirement Planning

Retirement planning services typically include projections on the likelihood of achieving a financial goal(s), with financial independence usually the primary objective. For situations where projections show less than the desired results, a recommendation may include showing the impact on those projections by making changes in certain variables (i.e., working longer, saving more, spending less, taking more risk with investments). If you are near retirement or already retired, advice may be given on appropriate distribution strategies to minimize the likelihood of running out of money or having to adversely alter spending during retirement years.

Financial Planning

Education Planning

Advice may include projecting the amount that will be needed to achieve post-secondary education funding goals, along with savings strategies and the “pros-and-cons” of various college savings vehicles that are available. We are also available to review your financial picture as it relates to eligibility for financial aid or the best way to contribute to other family members.

Tax Planning Strategies

Advice may include ways to minimize current and future income taxes as a part of the overall financial planning picture. For example, recommendations may be offered as to which type of account(s) or specific investments should be owned based in part on your “tax efficiency,” with consideration that there is always a possibility of future changes to federal, state, or local tax laws and rates that may impact a person’s situation.

Estate Planning and Charitable Giving

Our review typically includes an analysis of your exposure to estate taxes and your current estate plan, which may include whether you have a will, powers of attorney, trusts, and other related documents. We may assess ways to minimize or avoid estate taxes by implementing appropriate estate planning and charitable giving strategies.

Divorce Planning

Separation or divorce can have a major impact on your goals and plans. We will work with you to help you gain an understanding of your unique situation and provide you with a realistic financial picture so that you are in a better situation to communicate with legal counsel, a mediator or soon to be ex-spouse. We can assist in the completion of cash flow and net worth projections, budgetary analysis, as well as help you to understand the financial consequences of a settlement.

Investment Consultation

Investment consultation services often involve providing information on the types of investment vehicles available, employee retirement plans and/or stock options, investment analysis and strategies, asset selection and portfolio design, as well as limited assistance if an investment account is maintained at another broker/dealer or custodian.

Business Consultation

We are available to assist small businesses in a variety of ways to include budgeting, employee retention and retirement strategies, as well as coordination with financial institutions, corporate attorney, or an accounting firm.

Wealth Management Services Fee Schedule

We do not require a minimum account size to open and maintain an investment account, nor do we assess account opening and/or administration fees to initiate our portfolio management services.

For the benefit of discounting our asset-based fee, we aggregate accounts for the same household.

We assess our advisory fee on a quarterly basis, in advance, per the following fee table. As your investment balance grows, Assets Under Management (AUM) fees drop.

WEALTH MANAGEMENT SERVICES | |

Portfolio Mgmt + Financial Planning | |

Assets Under Management | Annualized Asset-Based Fee |

$0-$499,999 | 1.15% |

$500,000-$999,999 | 0.9% |

$1M-$2,999,999 | 0.65% |

$3M-$4,999,999 | 0.55% |

$5M+ | 0.5% |

Worthen Financial Advisors, Inc. has designed our services to meet the diverse financial planning and investment management needs of our clients. Following are the principal service offerings that Worthen Financial Advisors, Inc. personalizes to each Client’s specific needs:

• Wealth Management Services

• Ongoing Financial Planning Services

• Standalone Financial Planning Services

• Hourly Consulting Services

by Launch Kits

by Launch Kits